-

Manbhawan-5

Lalitpur, Nepal

-

You may send an email

connect@finedusheel.org

-

Helpline and support

015420252

February 17, 2026

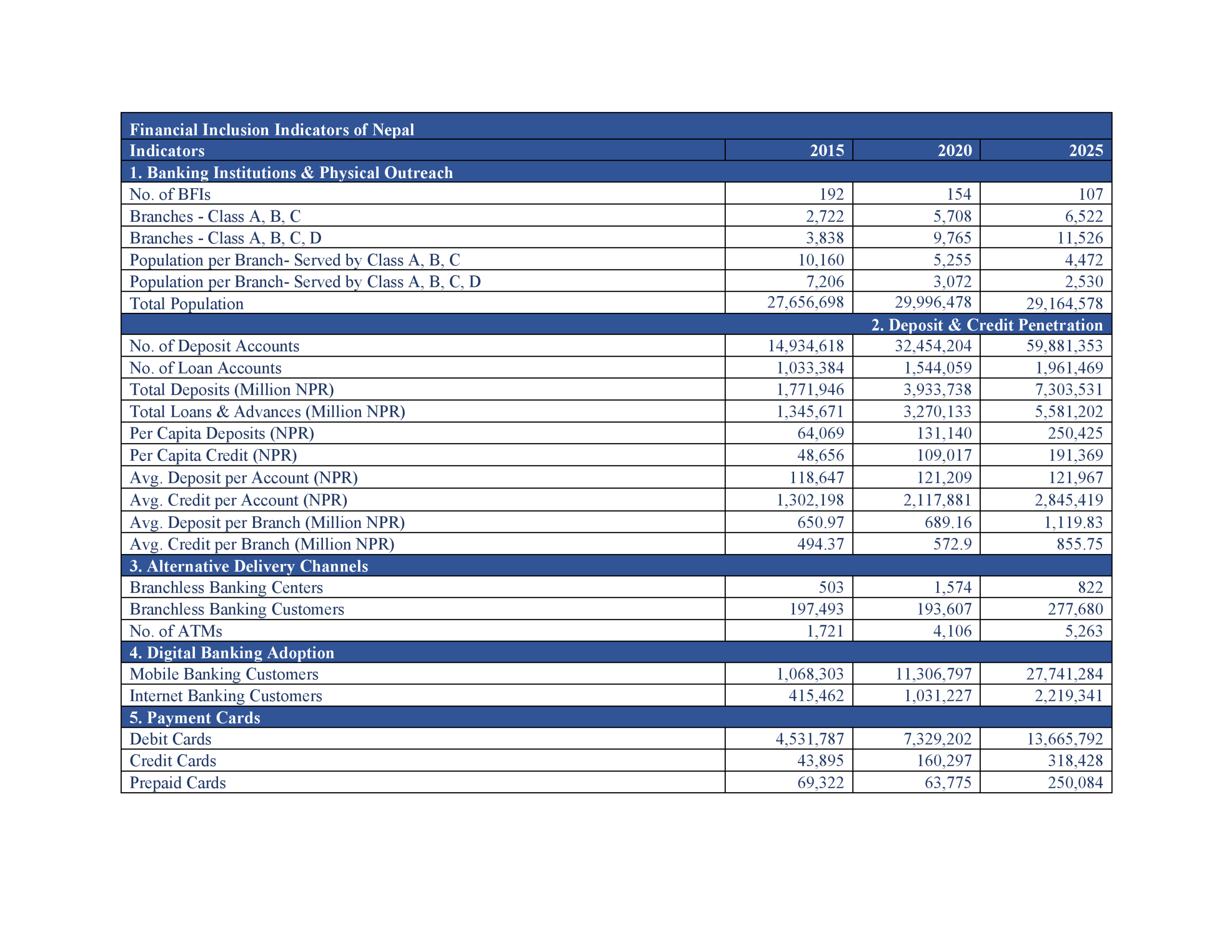

Over the past decade, Nepal has made remarkable strides in financial inclusion. While access has expanded, the focus is now shifting toward quality and choice.

Key milestones (2015 → 2025):

- Branches: 2,722 → 6,522, reducing population per branch from 10,160 → 4,472.

- Deposit accounts: 14.9M → 59.9M; loan accounts: 1.03M → 1.96M.

- Digital adoption: Mobile banking users 1.07M → 27.7M; Internet banking users 415K → 2.2M.

- ATMs and card usage: ATMs 1,721 → 5,263; debit cards 4.5M → 13.6M; credit cards 44K → 318K.

While these numbers highlight impressive growth, true financial inclusion is not just about access—it’s about enabling choice.

To empower users, Nepal needs:

- Financial aggregators that allow people to compare products and select what fits their needs.

- Business Development Services (BDS) offering guidance, literacy, and support to navigate financial options effectively.

Financial inclusion is evolving from reach → quality → choice. Nepal has built the infrastructure; now it’s time to give people control over their financial decisions, ensuring the system works for everyone, not just anyone.