-

Manbhawan-5

Lalitpur, Nepal

-

You may send an email

connect@finedusheel.org

-

Helpline and support

015420252

February 17, 2026

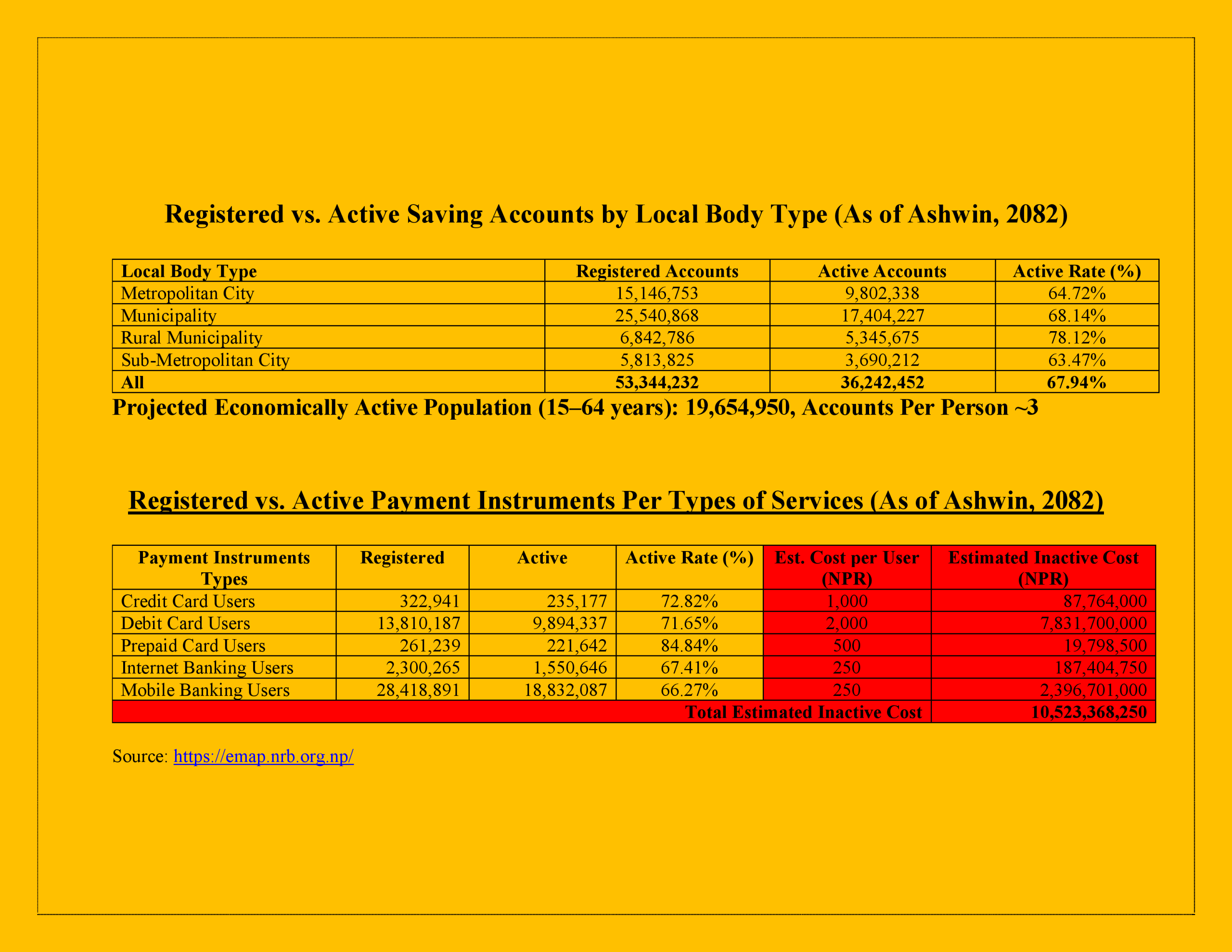

Financial inclusion in Nepal has grown quickly. Digital banking services are now more widely available than ever. But the usage data tells a different story. A large share of accounts and payment instruments remain inactive, while the costs of infrastructure, issuance, and maintenance continue to accumulate.

The question is simple: Are digital infrastructure and distribution costs being indirectly shifted to the public through financial products people do not use?

This is a question that needs open discussion among regulators, banks, and the public.

Evidence from Current Data (Ashwin 2082)

Saving Accounts- Registered accounts: 53.3 million

- Active accounts: 36.2 million

- Active rate: 67.94 percent

- Inactive accounts: around 17 million

- Economically active population: approximately 19.65 million

- Accounts per person: roughly three

- Debit cards: 71.65 % active

- Credit cards: 72.82 % active

- Mobile banking: 66.27 % active

- Internet banking: 67.41 % active

- Prepaid cards: 84.84 % active

Is the Regulator Unaware?

It is unlikely that the central bank is blind to these numbers. Inclusion dashboards already track registered versus active accounts, and the gap is clear. The real question is whether the risks from over-issuing products and low usage are treated as a core consumer protection issue or just as statistics. Nepal Rastra Bank has led major digital and inclusion reforms. The next step is to move from simply counting registrations to measuring usage quality and fair conduct. Markets evolve, and regulation must evolve with them.Where the Risk Lies

The problem is not technology. Digital infrastructure is necessary and good. The risk comes from the way products are distributed:- Customers are enrolled into cards or digital channels by default in general

- Products are bundled at account opening or with loans in general

- Staff are pressured to issue volume rather than focus on actual usage

- Fees may be charged even when products remain unused or dormant

Practical Policy Solutions

1. Usage-Based Reporting- Track and report active accounts and active instruments, not just registrations

- Require institutions to disclose inactive ratios

- Do not charge annual or service fees until the first transaction is made

- Automatically waive fees for dormant accounts

- Require separate consent for each renewal

- Conduct periodic audits of sales practices

- Perform random customer verification calls

- Penalize forced selling or coercive practices